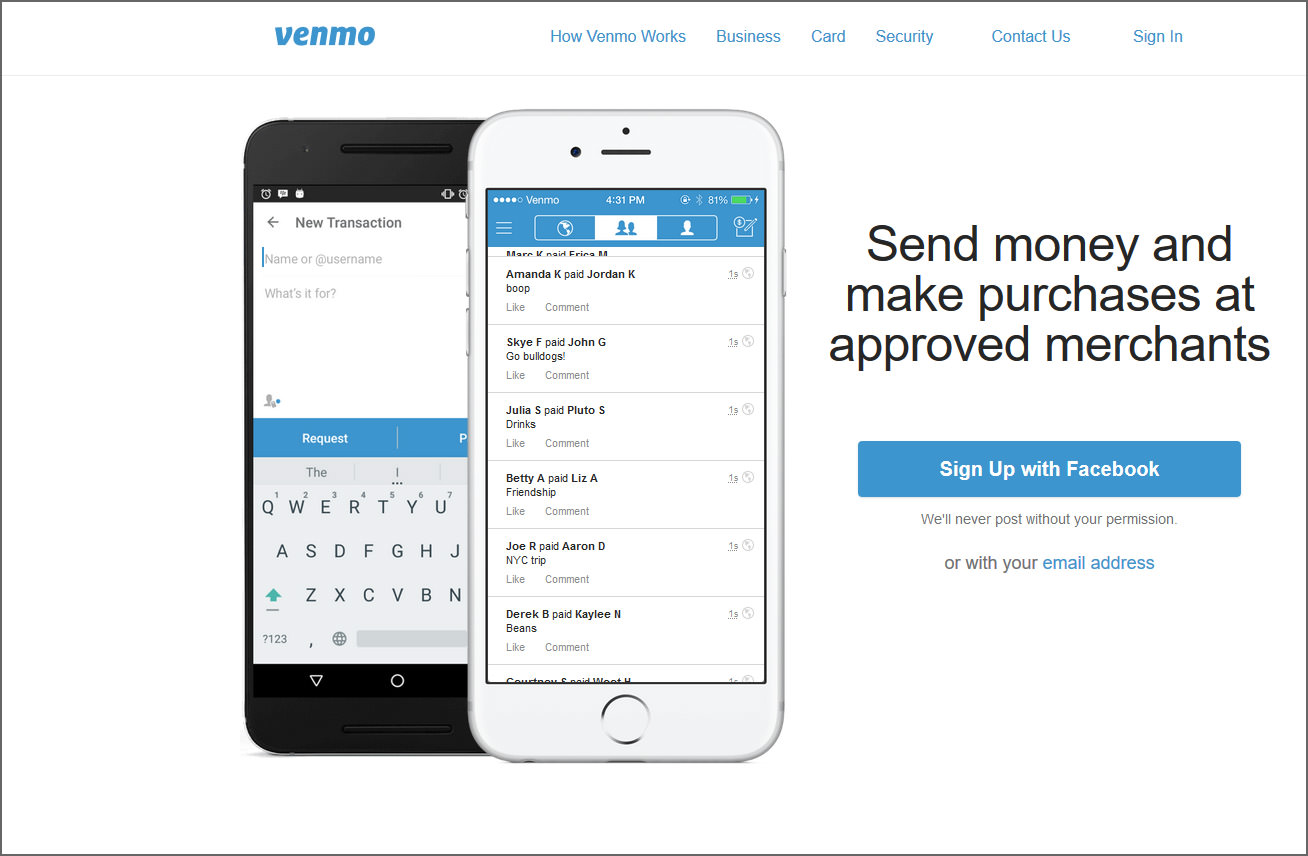

If you're looking for those benefits, consider a travel rewards credit card. You also can access a virtual account number instantly after card approval, meaning you can use the card right away while waiting for it to come in the mail.Īs a no-annual-fee card, don't expect perks like travel credits, lounge access or travel insurance. The card also is integrated with the Venmo app to track activity, and you can apply payments from friends directly to your credit card bill.

#Venmo virtual debit card code

The Venmo card has your personal QR code on it, so people can scan it and go straight to your Venmo profile to send you money. Related: Everything you need to know about Visa Signature card benefits Those with a Visa Signature card also have benefits with Shipt, Sofar Sounds, Skillshare and NortonLifeLock. Depending on the card type you receive, you'll enjoy benefits like emergency card replacement and emergency cash disbursement, auto rental collision damage waiver, zero liability policy and roadside dispatch. The Venmo card can be issued as a Visa Traditional or Visa Signature card. WESEND61/GETTY IMAGES Venmo Credit Card benefits Related: Why you should get a fixed-rate rewards credit card This can be a strong part of your overall points and miles strategy. With fixed-rate rewards, you'll never wonder what your earnings are worth. Since your rewards are redeemed as cash, they have a flat-rate value of 1 cent. Related: Interested in earning crypto on your credit cards? Here’s what you need to know Purchasing automatically has no cryptocurrency transaction fee, unlike standard cryptocurrency purchases with Venmo. Options include Bitcoin, Bitcoin Cash, Ethereum and Litecoin. You have two options for your earnings.įirst, you can use the cash back in your Venmo balance to pay bills or send money to friends.Īlternatively, you can redeem your earnings to auto-purchase cryptocurrencies. Related: 5 reasons to add the Venmo Credit Card to your wallet Redeeming cash back on the Venmo Credit CardĪll rewards from the Venmo card will be added to your Venmo account balance within three days of a statement closing. After passing the $2,500 threshold, you'll earn just 1% back in your top spending category.ĭo note that you won't earn cash back when sending money, such as electronic funds transfers, money transfers or wire transfers. For example, the Bank of America® Customized Cash Rewards credit card has a limit of $2,500 each quarter, which is shared across your 3% and 2% cash-back categories. Other cards with similar earning structures limit how much you can earn in the top bonus category.

There are no earning limits, which is a nice perk to this earning structure. You'll earn 2% back on your next-highest spending category and 1% back on other purchases.

The Venmo card occasionally offers welcome bonuses. However, the card is more than just the name it bears, offering a quality earning structure and a choice of redemption options that will please many people.ĭespite the uniqueness of choosing which color you want your card to be, the lack of an annual fee on the Venmo card also leads to a lack of perks you may be looking for in a credit card.ĭoes the Venmo card deserve a place in your wallet? Here's what you need to know to make that decision. The Venmo Credit Card is issued by Synchrony Bank, is available in five colors and bears the name of a popular peer-to-peer payment system. The card details on this page have not been reviewed or provided by the card issuer. The information for the Venmo Credit Card has been collected independently by The Points Guy.

Card rating*: ⭐⭐⭐ *Card rating is based on the opinion of TPG’s editors and is not influenced by the card issuer. Those looking for uncomplicated cash back without frills will enjoy this card.

#Venmo virtual debit card plus

The Venmo Credit Card offers a seamless connection with your Venmo account and has no annual fee, plus it adapts to your spending habits automatically with its bonus categories.

0 kommentar(er)

0 kommentar(er)